i think the message is we all need to be realistic.

Servicing the national debt is now over £100bn a year (so 10% of all tax received) and many of our public services are on their knees following years of underfunding.

After covid and the c£400bn spent surely taxes needed to rise to part pay for this but instead national insurance was cut twice.

Welfare costs (which include the state pension BTW) are increasing and with Trump not prepared to support Europe defence spending will increase from 2.5% to 5%.

How is this going to be paid for?

As a standard rate tax payer i pay 28% (20% income tax plus 8% NI) which is the lowest i have paid in 35 years of work.

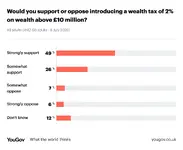

Nobody likes to pay more tax but as long as the higher earners pay the most i think that's the best outcome we can hope for.

It's strange that no Labour politician, to my recollection, has mentioned the cost of Covid as one of the prime reasons behind the size of the national debt. They prefer to keep referencing on how the Tories, principally Truss, '' crashed the economy ''.

Personally, I would have understood and supported a rise in income tax under the circumstance.

When it comes to Welfare Costs, this is one of the areas where Labour are failing. They may know what needs to be done but can't get enough internal support to generate the required savings. So what's the answer ? Tax people.

I'm now a pensioner, but I'm realistic enough to understand that the Triple Lock is increasingly unsustainable. However, more pensioners, myself included, are now getting dragged into a tax paying bracket thanks to the thresholds remaining in place. That eats into any increase in the State Pension.

Then we come to Labours definition of a '' working person ''. They have yet to define that in any understandable way. The media speculation is that anyone earning less than £45k pa is going to be classified as such. Which then places the potential tax increases to those earning above that figure. Is £45k a fair assessment of being a '' high earner '' - I don't think so. Especially in London and South East.

From the brief research I have done, in 2024 the average London salary was £66k and the National average, £45k.

I spent my career in the City and earned well from it and got taxed accordingly. Was I a '' working person '' ? Well, I left home at 6.15am and got home between 7.30-8.30pm and it certainly felt like I'd done a days work !

I think it's a complete cop out to just say let the high earners pay more and more. For what return ? Just to subsidise those that feed off of a State that cannot or will not implement the welfare reforms that are needed ? Or to fund the Public Sector / Unions that Labour are in hoc to ? If she's serious about '' everybody doing their bit '' then she has to get those sectors in order to make any tax increases palatable.

Reeves talks about growing the economy and yet so far the majority of her actions are actually stunting in. I have no confidence in the forthcoming budget doing anything to reverse that.

And I haven't even started on breaking their Manifesto promise yet !