PalazioVecchio

Member

- Location

- Area 51

- Country

USA

USA

Rumours of a recent gentle-correction turning into a full-blown sh1.tstorm ?

Maybe improved affordability will be good ? Good for college-Leavers and first-time-buyers ?

www.cityam.com

www.cityam.com

www.lbc.co.uk

www.lbc.co.uk

moneyweek.com

moneyweek.com

www.businesstimes.com.sg

www.businesstimes.com.sg

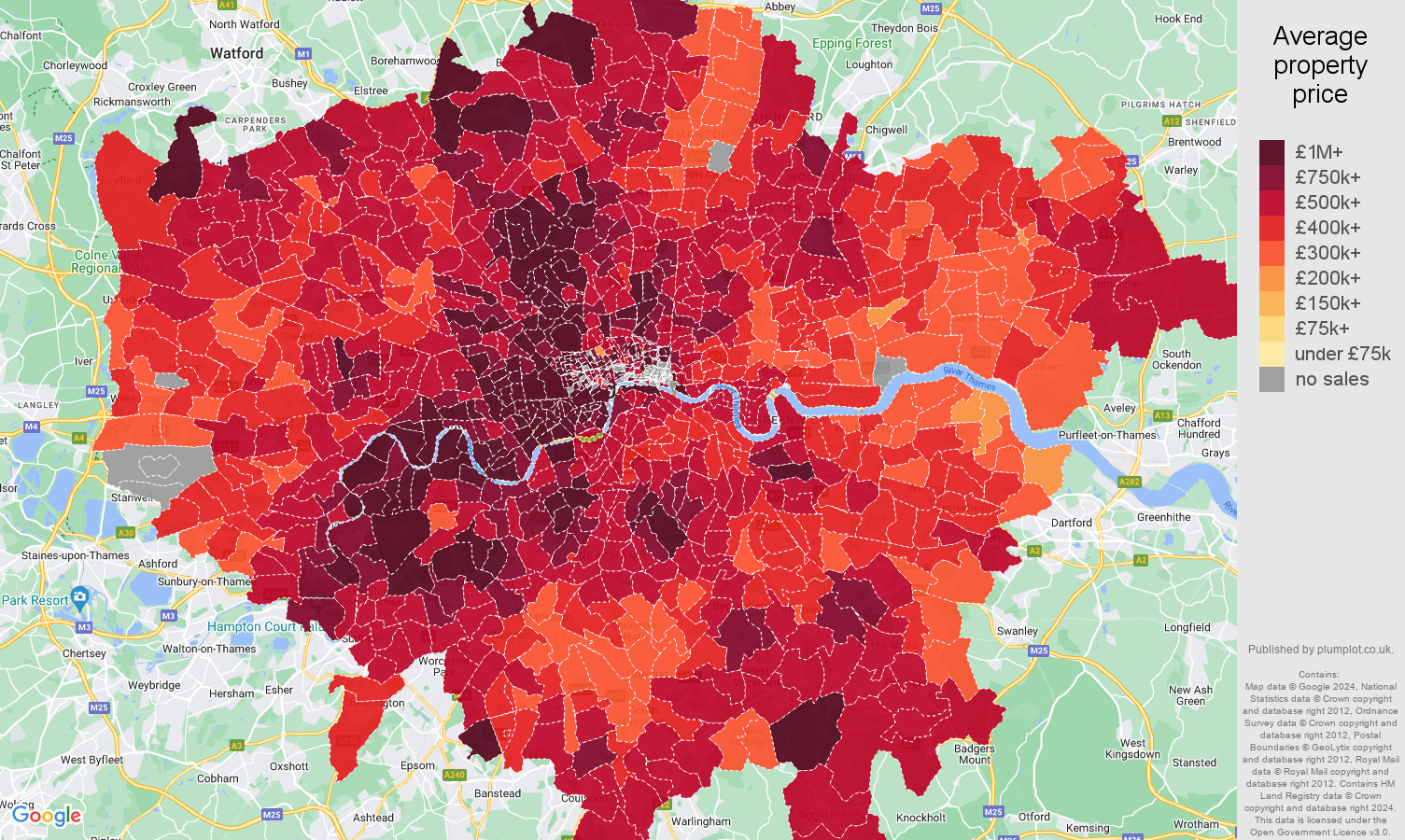

Like a kids party-magician squeezing a sausage-balloon. When the centre contracts, the periphery expands. Prices are up in Scotland, Wales, and N.I.

It's been 17 years since the last crash. So economic-theory is solid. Maybe the lemmings are selling-up 12 months earlier, to beat the rush ?

www.propertyinvestmentsuk.co.uk

www.propertyinvestmentsuk.co.uk

Maybe improved affordability will be good ? Good for college-Leavers and first-time-buyers ?

'Stockbroker belt' suffers biggest house price declines in 2025

Patches of London's 'stockbroker belt' suffered the largest decline in house prices this year, as the capital fell behind the north

House prices fall unexpectedly towards end of 2025, new figures reveal | LBC

Experts have partially blamed hesitation around the Budget for the fall

Where did house prices rise and fall the most in 2025?

Some parts of the UK have seen yearly property price growth of up to 12.6%, but others have seen values fall by as much as 8.9%, research shows.

moneyweek.com

moneyweek.com

UK house prices in surprise drop at end of 2025

Nationwide Building Society says the average price of a home in December has gone down 0.4% to £271,068 Read more at The Business Times.

Like a kids party-magician squeezing a sausage-balloon. When the centre contracts, the periphery expands. Prices are up in Scotland, Wales, and N.I.

It's been 17 years since the last crash. So economic-theory is solid. Maybe the lemmings are selling-up 12 months earlier, to beat the rush ?

What is the 18-Year Property Cycle? Where Are We Now?

What is the 18-Year Property Cycle? Why do markets lurch from boom to bust? Where do we find ourselves in this cycle?

Last edited: